Small Screens: Cast Reductions for 'All American: Homecoming', Restructuring at NBCUniversal Boosts Donna Langley

Peyton Alex Smith - Paras Griffin

Broadcast: Amidst budget cuts and cast reshuffling at the CW, All American: Homecoming’s original male lead, Peyton Alex Smith, as well as Kelly Jenrette will be bumped from series regulars to likely recurring characters in the upcoming third season. Most of the rest of the cast from last season will return as series regulars, including series star Geffri Maya as well as Sylvester Powell, Netta Walker and Mitchell Edwards, but some, including Cory Hardrict and Rhoyle Ivy King have reduced episodic guarantees. The fact that All American: Homecoming is returning for a third season at all represents a beating of the odds, however, as, after Nexstar acquired the CW, all scripted shows besides Homecoming and Superman & Lois were canceled. These series, as well as Walker, which the network recently picked up, must now follow the low-cost model of the new owners (who are turning more and more toward acquired titles and co-productions). Budget-related cast reductions are fast becoming a trend, as well. Fans of Superman & Lois, for example, will see only four of the twelve regulars from last season in the next season; Bob ❤️ Abishola, the CBS comedy picked up by WBTV, will only have leads Billy Gardell and Folake Olowofoyeku as regulars for the next season; and the CBS pillar Blue Bloods was only renewed for a fourteenth season after the cast agreed to a 25% pay cut.

On July 3, about 159 ABC, CBS, Fox, and CW affiliates went dark for up to 10 million viewers due to a carriage dispute between Nexstar and DirecTV (while Nexstar says 10 million were affected, DirecTV says a significantly lower number of its base of almost 13 million were affected). With the WGA strike and the possibility of a SAG-AFTRA strike limiting content during the already slow season of summer, Nexstar and DirecTV seem more willing to play hardball. Nexstar, the largest local-station owner in the U.S., has a contract whereby DirecTV, the country’s third largest pay-TV provider, distributes Nexstar’s content on its main satellite service, internet bundle, and U-verse cable systems, but that contract was last negotiated several years ago. Nexstar claims DirecTV keeps raising its charges to customers without passing on profits to Nexstar, whereas Rob Thun, chief content officer of DirecTV counters that Nexstar has “a long track record of forcing programming outages in an effort to unnecessarily raise prices.” The two companies are also fighting on the front of a lawsuit and FCC complaint in which DirecTV charges Nexstar uses “sidecar deals” to artificially increase its scale and circumvent federal ownership limits. Nexstar counters that its “shared service” deals with other broadcasting companies are in full compliance with FCC rules. All of this comes at a time when people are turning away from pay-tv and pay-tv platforms are dropping networks. DirecTV has lost about 15% of its total subscribers in the last three years, and Dish Network, for example, let go of regional sports, HBO, and other networks years ago. However, this decline only makes individual carriage deals more important as cable and broadcasts fight to stay alive. Nexstar, for example, took a 75% stake in the CW last fall, following the strategy that a greater distribution scale can secure greater fees. Its distribution revenue rose 4% last year to almost $2.6 billion.

Jacob romero and kyle bary - Alexandre Schneider / Stringer / Anadolu Agency

Cable: Jacob Romero (Greenleaf) and Kyle Bary (Ginny & Georgia) are joining Issa Rae’s Max series Rap Sh!t in key recurring roles for Season 2. Rap Sh!t, created and executive produced by Rae, with Syreeta Singleton as showrunner, follows:

“...two estranged high school friends from Miami, Shawna (Aida Osman) and Mia (KaMillion), who reunite to form a rap group. In their rise to fame, Shawna and Mia find themselves at a pivotal moment in their rap career as they are forced to decide if they will stay true to themselves or conform to the demands of the music industry.”

Romero will play Lord AK, a notable LA rapper, with Bary as his friend and opening act for his tour, up-and-coming rapper Courtney Taylor. Romero (represented by SDP Partners and attorney John Meigs) may also be seen as AJ in OWN’s Greenleaf, as well as the upcoming live-action adaptation of the anime/manga series One Piece on Netflix. Bary (represented by Brillstein Entertainment Partners, CESD, and Gang, Tyre, Ramer, Brown, & Passman) is perhaps best known as young Zion Miller in Netflix’s Ginny & Georgia and may also be seen in Our Kind of People as Quincy Dupont.

Janet Hubert - Noam Galai / Stringer

Streaming: Janet Hubert, best known for portraying Vivian Banks on the Fresh Prince of Bel Air, will guest star on Netflix’s Sweet Magnolias for season 3. Hubert will play Helen’s (Heather Headly) mother, Bev Decatur, who is described as supplying Helen with a “unique blend of humor, compassion, and tough love.” Hubert may also be seen most recently in Netflix’s The Perfect Find, as well as films such as Single Black Female and television series Last OG, General Hospital, and more. JoAnna Garcia Swisher, Brooke Elliott, Heather Headley, Chris Klein, Jamie Lynn Spears, Justin Bruening, Carson Rowland, Logan Allen, Chris Medlin, Anneliese Judge, Brandon Quinn, and Dion Johnstone also star in Sweet Magnolias. It is executive produced by Sheryl J. Anderson, who also serves as showrunner. For a tease of the third season, the logline, per Netflix, reads:

“Following the brawl at Sullivan’s, Maddie wrestles with the best way to help Cal and works to clear her own emotional path. Helen faces difficult decisions about the men in her life. And Dana Sue searches for a way to use Miss Frances’ check to help the community, without upending her family. The identity of the tire slasher sends shockwaves through Serenity, the recall causes unexpected consequences, and there are romantic surprises in every generation. Throughout the season, the ladies tackle these problems — and all the complications they cause — with their trademark warmth, humor, and devotion to each other and those they love. And margaritas,”

Viewers can now watch Issa Rae’s Insecure on Netflix, the first of a batch of HBO content to show on the streaming service which also includes Band of Brothers, The Pacific, Six Feet Under, and Ballers. True Blood, which also currently streams on Hulu, will be available to Netflix subscribers outside the U.S. The licensing deal between Warner Bros. Discovery and Netflix, which was first reported on June 20, signals WBD CEO David Zaslav’s new strategy of licensing the Warner Bros. and HBO libraries beyond WBD platforms, gaining top dollar and as many eyes as possible. This can perhaps be seen as a return to the old strategies from before the “streaming wars” of 2018/19, and before the company’s previous leadership started focusing on leveraging its top content to build up the streaming platform Max. In January, WBD also partnered with Roku and Tubi to launch free ad-supported channels with HBO programming, and in 2014, HBO and Amazon made an exclusive licensing deal to stream heavy HBO hitters such as The Sopranos on Amazon Prime Video. All of these shows, in any case, can still be streamed on Max.

HBO’s A Black Lady Sketch Show, created, written, executive produced, and starring Robin Thede, will not return for a fifth season. Per the logline, the series

“...featured a core cast of Black women living funny, relatable experiences in a magical reality that subverts traditional expectations.”

In its four-season run, A Black Lady Sketch Show won three Emmys (including for the first Black woman to win directing for a variety series, Bridget Stokes), the TCA Award for Outstanding Achievement in Sketch/Variety Shows, five Black Reel Awards, one HCA Award, and two NAACP Image Award nominations. Gabrielle Dennis, Ashley Nicole Black, and Skye Townsend also starred, and Thede executive produced with Issa Rae for Hoorae, along with Dave Becky, Jonathan Berry for 3 Arts Entertainment, and Tony Hernandez and Brooke Posch for Jax Media. While HBO and Thede mutually decided to end the show after Season 4 (which wrapped in May) on a high creative note, Thede still has an overall deal with HBO and is currently developing a half-hour comedy series called Disengagement.

With Amazon, Google, NBCUniversal, and more embracing free, ad-supported, streaming TV, or FAST, and with Ted Sarandos publicly stating Netflix is keeping an eye on the format, there is growing speculation around not only if, but when Netflix will fall in with FAST fascination. While FAST revenues are forecast to grow both domestically and globally in the coming years (with the FAST market in the U.S. projected to hit $10.1 billion by 2027), ASAP would be the time to join in order to maximize revenue gains. However, the internal strategy at Netflix might be to hold onto the FAST card as a big announcement and to use it to boost stock prices in the event of a poor earnings report. In any case, if and when Netflix does put out its own FAST channels, it will probably use the pre-programmed, linear channels to supplement its paid, viewing-on-demand service (as opposed to releasing an ad-supported viewing-on-demand service as well); that way there’s no Wall Street freak-out about potential cancellations, and the draw of on-demand viewing is still reserved for subscribers paying top dollar. And while Netflix might follow Pluto’s example of licensing out its channels to get as many eyes as possible (in addition to some exclusive channels), keeping most everything under one Netflix roof will best leverage the company’s huge branding power (especially when there are already 20 other major and minor FAST services out there). Packaging older original content into curated channels like “Netflix Hit Movies” or “Netflix True Crime” might also help with viewer traction, while releasing pop-up channels around series with new seasons coming out or recent award winners might help create new buzz. In any case, with its extensive content library, home-name brand power, and global distribution, Netflix has what it takes to become the next big thing in FAST.

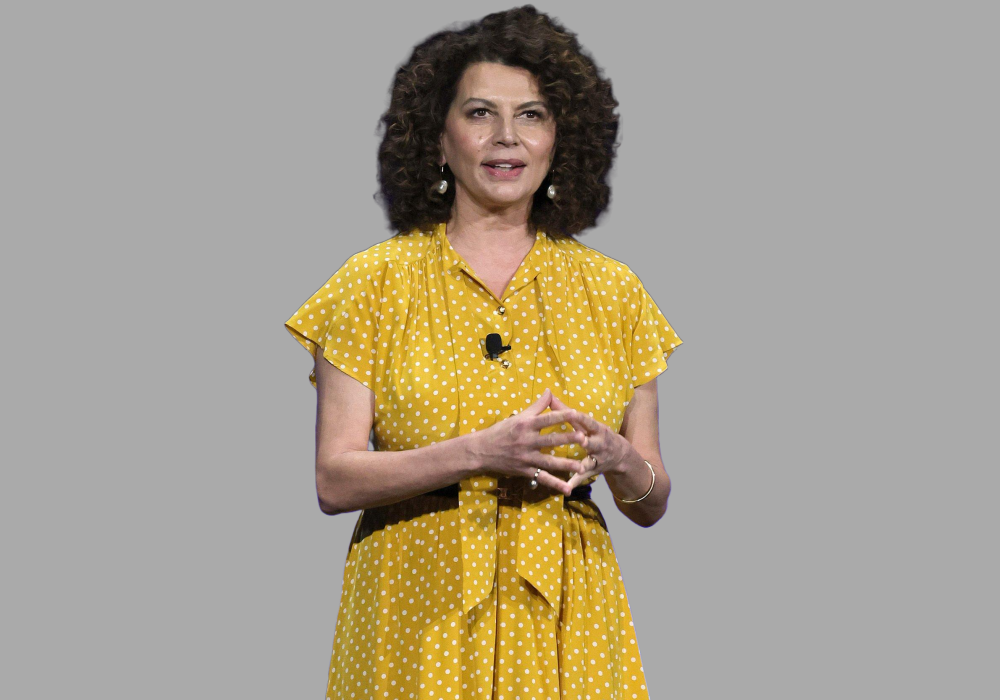

Donna Langley - Ethan Miller

Industry: Joanna Abeyie is stepping down as the BBC’s head of creative diversity as of July 3rd. Beginning the role only in April 2022 as the interim head of creative diversity, and as the full-fledged head in October, Abeyie oversaw the BBC’s first Creative Diversity Plan in 2020 and was working on the next edition, which covers on-air representation and production and possibly new ways to measure creative diversity. Director of Content Charlotte Moore describes the great impact Abeyie had in her short tenure, saying in a note to staff,

“She’s achieved such a huge amount within the Content division in the last year – drafting our Creative Diversity plan with input from many of you which will be an important part of her legacy; helping us deliver this year’s diversity fund commitments; supporting and championing Creative Diversity both inside and outside the BBC; working with suppliers and commissioners across TV, Radio & Music, Children’s & Education and Sport to deliver training and provide editorial support and advice; not to mention representing the BBC on numerous industry panels and advising on complex diversity issues.”

Chinny Okolidoh, the BBC’s group director of diversity and inclusion, announced she will soon appoint an interim head of creative diversity and that the role would be advertised in due course (making whoever gets the position the third creative diversity leader at the BBC in two years). Abeyie’s exit comes amidst a spate of exits for senior diversity and inclusion leaders, including Jeanell English, executive VP of impact and inclusion at the Academy of Motion Pictures Arts and Sciences (reported last week after less than a year on the job); Karen Horne, who was laid off from her role as a diversity, equity, and inclusion executive at Warner Bros. Discovery; Latondra Newton, Disney’s chief diversity officer and senior VP; and Vernā Myers, head of inclusion strategy at Netflix. Despite the other recent staff changes in the industry, as well as protests from staff in response to her leaving, it seems the split is motivated by Abeyie’s personal choice to return to her consultancy business, Blue Moon, which specialized in diversity and inclusion and executive recruitment. Abeyie may also possibly consult for the BBC in the future.

NBCUniversal is restructuring staff as Comcast President Mike Cavanagh takes over from Jeff Shell (who stepped down after an investigation into sexual harassment). Donna Langley – who has been with Universal since 2001 and rose from SVP Production to Chairman, of Universal Filmed Entertainment Group – has been promoted to Chairman, NBCUniversal Studio Group & Chief Content Officer. Her duties will go from overseeing creative and business strategies for the motion picture group (where she oversaw franchises from Fast & Furious to Illumination’s Despicable Me) to overseeing all entertainment divisions, including film and TV, from Universal Pictures to Dreamworks Animation to Universal TV. Langley is one of four executives being given more responsibilities as operational heads under Cavanagh’s leadership. While Cavanagh, with previous experience as an investment banker and CFO of Comcast, has been speculated as a placeholder meant to search for Shell’s replacement, he has not named a new CEO. In addition to Langley’s promotion. Mark Lazarus, who was Chairman of NBCU Television and Streaming, will become Chairman of NBCU Media Group and will run the company’s TV and Streaming platforms, distribution, monetization, and affiliate relations. Cesar Conde will also run an expanded NBCU News Group and Mark Woodbury will run the Universal Destinations and Experiences Group. Frances Berwick was also promoted to Chairman of NBCU Entertainment (covering original content across broadcast, cable, Peacock, and linear networks); Susan Rovner, Chairman, Entertainment Content for NBCU’s Television and Streaming Division, is leaving; and Kimberley Harris, Anand Kini, Adam Miller, and Craig Robinson will take added responsibility as key corporate leaders.

Alicia J. Keyes is leaving her role as New Mexico’s Economic Development Department Secretary on July 13. Appointed by Governor Michelle Lujan Grisham in January 2019, Keyes was the first woman to lead the EDD. Furthermore, with experience as a Disney executive and producer of movies such as Biomass and Blaze You Out, as well as a former film liaison for the city of Albuquerque, Keyes has helped grow a film, TV, and digital media economy in New Mexico that hit a record $855.4 million in the fiscal year of 2022, a 36% increase from 2021. Gov. Lujan Grisham lauded Keye’s impact on the state’s economy:

“New Mexico’s economy is booming, and it’s more diverse than ever before. Wages are higher and we’re seeing historic job numbers. That’s no accident. Secretary Keyes’ commitment to carrying out the vision of my administration and her dedication to making New Mexico a great place to live have been integral to the economic health of our great state.”

Her statement is hardly an exaggeration as New Mexico’s unemployment rate is the lowest it’s been since 2007, the Job Training Incentive Program has recorded its highest average wage at $27.08/hour, and the Local Economic Development Act is projected to have a ten-year economic impact of $34 billion. Keyes also spearheaded efforts to establish key investments and relationships along the border, attract new and expanded aerospace investment, and create an Office of Outdoor Recreation. The administration is actively seeking a successor.

Nadji Jeter has signed up to be represented by the talent management company Cultivate Entertainment Partners. Making his film debut in Dirty Laundry in 2006 (written and directed by Maurice Jamal), Jeter has reached BAFTA-nominee status (Performer in a Leading Role) for his work voicing Miles Morales in the Spider-Man: Into the Spider-Verse PlayStation game. He can also be seen in films including Oscar-winning Wonder and, most recently Miss Virginia, as well as series such as Marvel/Disney XD’s Spider-Man (in which he also voices Miles Morales), Grey’s Anatomy, and Grown-ish.

Urban One Inc. – the largest U.S. radio broadcaster targeted toward Black listeners - is seeking to further diversify its holdings and is joining the fray of groups vying to acquire media company BET Group. Founded in 1980 in D.C. by Bob and Sheila Johnson as Black Entertainment Television, BET was sold to Viacom in 2001 and is now being sold by Paramount for an asking price of $3 billion. While Urban One is still doing its “due diligence” according to CEO Alfred Liggins, the company would be competing with the likes of filmmaker and executive Tyler Perry, producer and entrepreneur Byron Allen, and Miami’s Group Black (which includes such celebrities as Shaquille O’Neal and 50 Cent) to be the new owner of BET. Liggins pointed to using a strategy of scale in the tough pay-TV arena, potentially adding BET to the two TV networks Urban One already owns: TVOne, which is targeted at Black viewers, and CLEO TV, a lifestyle and entertainment network aimed at millennials and Gen X women of color. However, the company’s $293 million market capitalization is less than a tenth of the reported asking price for BET, and the company has not yet named any potential bidding partners. Final bids are reportedly due by the middle of this month.

With ad-supported tiers quickly becoming a notable source of income for streaming services, it seems media companies are still being picky about where exactly that income is coming from. Take Disney for example, which said in 2019 that it would not run other streamers’ ads unless they had a broader relationship, potentially including advertising, distribution, or programming. However, while you might not see ads for Amazon Prime on Disney+ or Hulu, for example, you can still see them on ABC or ESPN, which are also owned by Disney. While for years, TV networks like ABC, CBS, and NBC steered away from commercials that even hinted at competitors (NBC and CBS even refused to air an ad involving an actor portraying a character similar to one he played on rival ABC in 1994), it seems TV has moved passed the aversion while streaming services are now catching it. Netflix, Max and Hulu, and Disney+ (both owned by Disney) do not accept ads that tout rival streaming services or the shows that run on them, while Paramount+ tends to only accept ads from competitors with whom the company does other business (NBCU’s Peacock and Amazon’s Freevee are exceptions who do take ads from rivals). However, while streaming companies are under pressure to grow subscription numbers as well as hours spent with their services, and while some ad-supported streaming tiers (such as Netflix’s new ad-supported tier, which launched in the U.S. in November) aren’t reaching enough consumers to attract big advertisers, discouraging them from doing anything to send consumers to rival platforms, the potential ad revenue is definitely alluring. Big entertainment and technology companies spent over $1.2 billion on commercials placed across traditional media in the first quarter of 2023 (according to Vivwix, an ad-spending tracker). Furthermore, as companies continue to expand and conglomerate, steering clear of rivals only becomes more difficult. For example, Netflix and Warner Bros. Discovery recently announced select HBO series would be available on Netflix, meaning placing ads on each other’s platforms might be beneficial. Apple’s streaming service telecasts Major League Soccer, which comes with promotions for RBC Wealth Management, which is technically a rival of the Apple Card and Apple Pay services. Yet, as it is commonplace to see ads for streaming services and the latest connected TV apps on TV, juicy ad revenues are likely to win out over the cautious rules streaming services are following right now.

Strike Watch: On July 5th, SAG-AFTRA sent an email survey to members asking if and how they’d be willing to participate in the event a walkout is called. It clarified,

“By taking this survey, you’re not obligating yourself to help, but it will help us make informed decisions about our members and resources if we ever need to ask for your assistance.”

The survey includes questions such as “In the event of a strike, are you able to picket in your Local?” and “In the event of a strike, are you interested in volunteering to support the strike? If so, please check all that apply.” While union president Fran Drescher told Good Morning America on June 29 that contract talks were making progress “in some areas,” she also added “in some areas, we’re not,” which adds up with the fact that the guild and the Alliance of Motion Picture and Television Producers, with which they are negotiating, had to extend the current contract beyond the original June 30 deadline to July 12 to allow negotiations to continue. Last week, more than 1,700 actors signed a letter to guild leaders saying they “would rather go on strike” and “join the WGA on the picket lines” than compromise on key issues. A month ago, citing bargaining issues including “economic fairness, residuals, regulating the use of artificial intelligence, and alleviating the burdens of the industry-wide shift to self-taping.”, 98% of SAG-AFTRA members voted in favor of authorizing a strike if contract talks fail to lead to an acceptable deal.

The WGA Strike and looming threat of a SAG-AFTRA strike is making things for UK actors, to put it nicely, a bit confusing. First and foremost, Equity – the London-headquartered union that covers 47,000 members including actors, singers, dancers, designers, directors, stage managers, voice artists, and more – is supportive of the Writers Guild and SAG-AFTRA and shares in its concerns over fair pay, artificial intelligence, and self-taped auditions. If SAG-AFTRA does strike, Equity will likely pause all work that’s governed by SAG-AFTRA contracts, with productions for local British broadcasters or independent films continuing because most don’t employ SAG-AFTRA actors. However, there are performers who are members of both Equity and SAG-AFTRA and if they are working under non-SAG-AFTRA contracts in place with companies that SAG-AFTRA is striking against, such as Warner Bros. Discovery or Netflix, you run into a gray area. As for the effects of the WGA strike, since the current policy for the Writers Guild of Great Britain has been that existing writing work can continue, but new work is discouraged, actors have to be brought in the back way for ongoing productions as they are not legally allowed to stop working, creating an ambiguous and uncomfortable situation. For Equity’s part, it is currently “preparing for a claim” around discussions with the producers’ organization, Pact, and the TV contract (covering streaming as well) which was last updated in 2021. While the timetable for negotiations is being worked out, it is expected to fall sometime within the next 12 months.